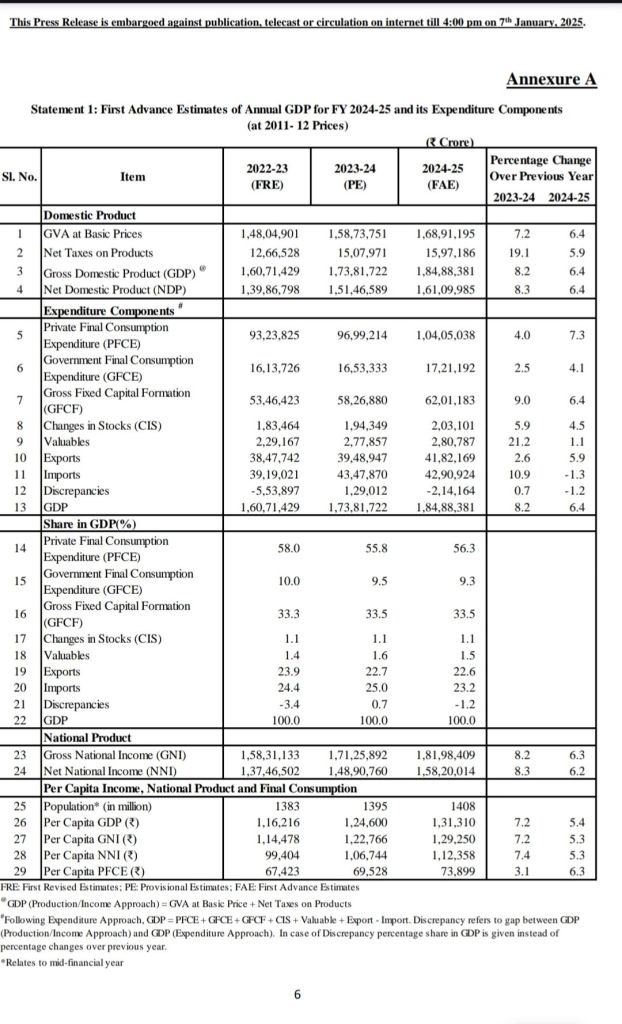

India’s economic growth has long been a beacon of hope in a turbulent global landscape. The First Advance Estimates (FAE) for 2024-25 reaffirm this position, projecting GDP growth at 6.4%—a strong showing, albeit slower than the 8.2% recorded in 2023-24.

The numbers tell a story of resilience, but they also whisper caution. The slowdown, while expected, raises pressing questions. Is this the natural tapering off of a post-pandemic rebound, or are deeper structural issues coming to the fore? More importantly, is India prepared to tackle the headwinds looming on the horizon?

Growth on Paper: Numbers That Speak

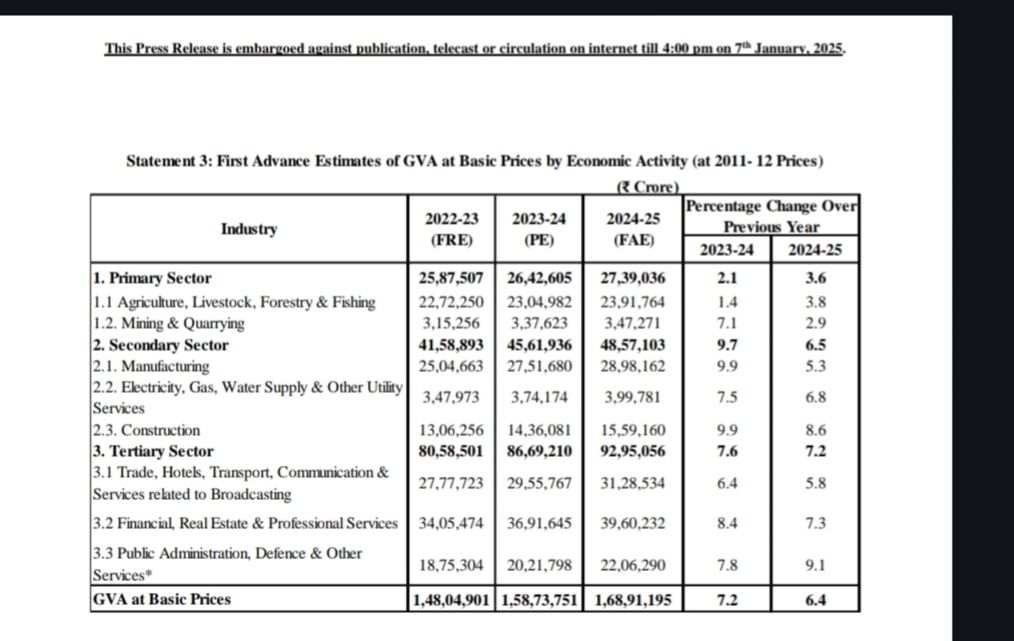

At ₹1,84,88,381 crore, the projected GDP for 2024-25 reflects confidence in the economy’s ability to sustain momentum. Yet the sharp dip from 8.2% growth to 6.4% cannot be ignored. The cooling off is most visible in manufacturing and construction, where growth has slipped to 6.5% from 9.7%, signaling bottlenecks and a potential loss of industrial dynamism.

The services sector, on the other hand, remains India’s bulwark, growing at 7.2%, driven by finance, trade, and IT. It needs to be noted here that 2 years ago, the same sector was growing at 10%. Meanwhile, the agriculture sector—often a barometer for rural health—manages a modest 3.8% growth, offering stability but also exposing vulnerabilities like inflation and erratic weather patterns. It continues to remain vulnerable to weather challenges.

The Consumption Puzzle

At the heart of India’s growth story lies consumption. And here, the cracks begin to show.

Private Final Consumption Expenditure (PFCE)—which accounts for more than half the GDP—grew 7.3%, a marginal improvement over 4.0% last year. But the numbers fail to inspire confidence. Rising inflation and stagnant rural wages are likely squeezing household budgets, while urban spending appears cautious despite improving incomes.

The growth this year shows some significant signs of positivity here. But it needs to be noted that this rise might be due to the rising inflation leading to higher consumption spending and not purely a demand rise as there is an overall slowdown in the economy. The per capita income growth shrank from 7.2 percent to 5.4 percent clearly reflecting that this growth in consumption demand is likely inflation driven.

Investment and Trade: A Balancing Act

Gross Fixed Capital Formation (GFCF)—a measure of investment—grew by 6.4%, reflecting continued faith in India’s infrastructure push and long-term growth potential. Yet sustaining this momentum will depend on private sector enthusiasm and global stability. It must be noted that this growth is a fall from the 9 percent growth last year.

Meanwhile, trade remains a mixed bag. Exports rose 5.9%, reflecting resilience despite global uncertainties. But imports shrank by 1.3 percent, raising concerns about domestic demand rather than signaling any structural correction in the trade deficit.

Reasons for Optimism: Growth Anchors

For all its challenges, India’s economy continues to exude strength:

- Increased consumption growth: Consumption remains the major component of GDP and increase in growth of it is a good sign.

- Services Sector Dominance: The 7.2% growth in services, particularly in finance and IT, underscores India’s global competitiveness.

The Cracks Beneath the Surface

But optimism must be tempered with realism. India’s growth story faces challenges that cannot be brushed aside:

- Manufacturing Slowdown: The drop to 6.5% growth exposes India’s vulnerability to global trade disruptions and domestic inefficiencies.

- Fiscal Constraints: Government spending growth of 4.1% leaves limited room for fiscal stimulus, especially with just coming out of an election year.

The Road Ahead: Time for Tough Choices

India now faces a defining moment. The growth slowdown may not yet be a crisis, but it is a wake-up call.

1. Reviving Demand:

The government must focus on rural stimulus programs, direct cash transfers, and employment guarantees to boost incomes. Urban incentives, including tax reliefs, could reignite discretionary spending.

2. Strengthening Manufacturing:

Simplifying regulations, improving infrastructure, and offering export incentives are critical to restoring industrial competitiveness.

3. Sustaining Investments:

Public-private partnerships and faster project approvals can keep infrastructure spending on track, creating jobs and spurring productivity.

4. Managing Trade Deficits:

India needs to diversify its export markets and reduce reliance on imports, pushing programs like ‘Make in India’ to strengthen domestic manufacturing.

5. Building Human Capital:

Skill development programs aligned with industry needs can address unemployment and workforce mismatches. The MSME sector, startups, and digital platforms must be prioritized for job creation.

A Moment of Reckoning

India’s 6.4% growth projection may still outshine most economies, but it no longer feels invincible. It is a reminder that growth alone is not enough—it must be equitable, inclusive, and sustainable.

The coming year will test India’s ability to navigate competing priorities—stimulating demand without inflating debt, encouraging investment without over-relying on public spending, and creating jobs without sacrificing productivity.

Policymakers face a balancing act, but the path forward is clear. With the right interventions, India can consolidate its gains and reignite its growth engine. Without them, the cracks could deepen, threatening to slow the momentum that has defined its rise so far.

India’s growth story is far from over, but the script for the next chapter will depend on bold decisions made today. The world is watching—and so are its citizens.