Introduction

India’s economy, one of the fastest-growing globally, is navigating a period of transition, balancing resilience with emerging challenges. In the first half (H1) of 2024-25, GDP growth moderated to 6.0%, down from 8.2% in H1 2023-24. While sectors like construction and public services provided a strong foundation, a slowdown in manufacturing and uneven employment distribution highlight critical areas requiring attention. This article delves into sectoral dynamics, employment trends, consumption, investment, inflation, and unemployment, prescribing measures to address challenges and sustain economic momentum.

Sectoral Growth vs. Employment Distribution

India’s growth engine is increasingly being driven by secondary and tertiary sectors, yet employment remains predominantly concentrated in the primary sector, reflecting a structural imbalance.

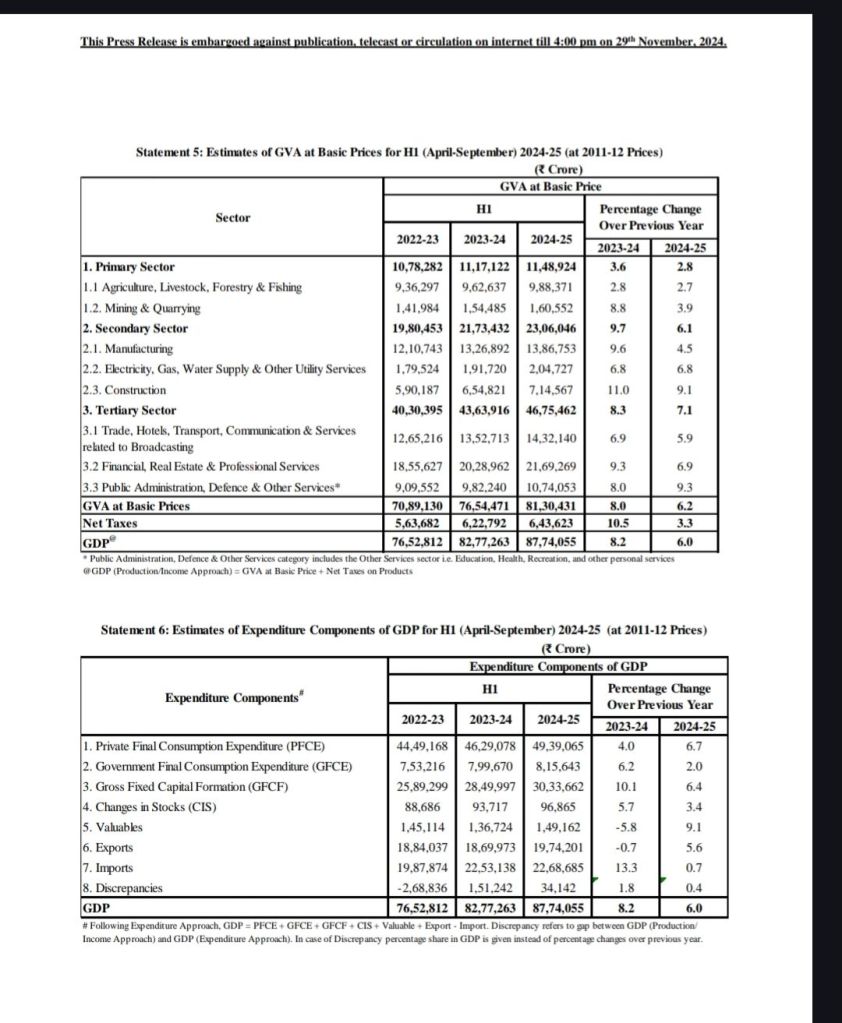

- Sectoral Growth:

The primary sector grew by 2.8% in H1 2024-25, compared to 3.6% in the previous year, highlighting stagnation in agriculture despite its critical role in rural livelihoods. Meanwhile, the secondary sector, encompassing manufacturing and construction, grew by 6.1%, down from 9.7% in H1 2023-24. Within this, construction exhibited robust growth at 9.1%, driven by infrastructure projects. The major drop has been in the manufacturing sector. The tertiary sector, which dominates India’s economy, grew by 7.1%, slower than last year’s 8.4%, with government-led services like public administration expanding significantly. - Employment Distribution:

Despite agriculture’s low productivity, it accounted for 46.1% of employment in 2023-24, underscoring the slow transition to industrial and service sectors. Manufacturing’s employment share stagnated at 11.4%, reflecting its inability to absorb labor despite its GDP contribution. The sectoral contribution numbers are as of 2023-24. In the above table we can see a decline in the growth of the manufacturing sector in 2024-25, making this sector more vulnerable in the coming year to absorb people. The services sector, while leading GDP growth, has not expanded its employment base proportionately.

Prescription: Addressing this mismatch requires targeted investments in rural infrastructure, mechanization of agriculture, and skill development to create higher-paying jobs in manufacturing and services.

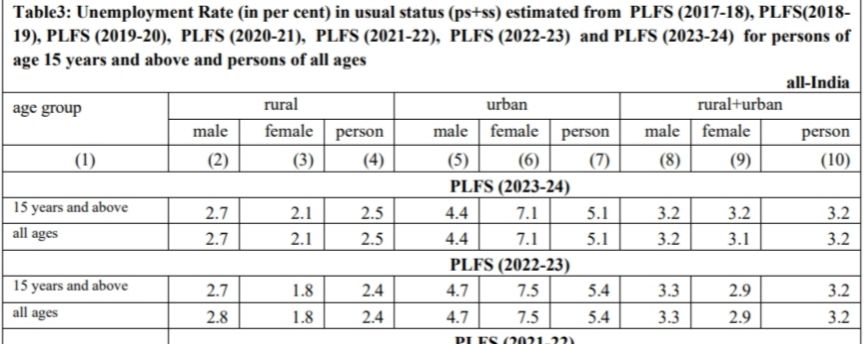

Unemployment Trends

India’s unemployment rate remained steady at 3.2% in 2023-24, with significant disparities across demographics and geographies.

- Urban Unemployment Challenges: Female unemployment in urban areas remains a concern at 7.1%, reflecting systemic gender inequities and the need for inclusive policies.

- Rural Resilience: The rural unemployment rate, at 2.5%, indicates better labor absorption but is primarily reliant on agriculture and informal sectors.

Prescription: Policies must focus on gender-inclusive employment initiatives, boosting urban labor demand, and formalizing the rural economy through micro-enterprises and cooperative models.

Consumption, Investment, and Comparisons

Consumption and investment trends highlight underlying economic strengths and weaknesses.

- Private Consumption: With a growth of 6.7%, private consumption in H1 2024-25 showed resilience compared to 4.0% in the previous year, driven by urban spending. Rural demand on the other hand has remained stagnated. This is also reflected by the fact that most of the people in rural India are dependent on agriculture, the growth of which has remained stagnated.

- Investment Momentum: Gross Fixed Capital Formation (GFCF) grew by 6.4%, slightly slower than 2023-24 but indicative of steady infrastructure and industrial investments at least in the urban sectors.

- Government Spending: A sharp decline in government consumption growth to 2.0% reflects fiscal tightening, despite its importance in driving public services and infrastructure.

Prescription: The government should prioritize fiscal allocations for health, education, and infrastructure while incentivizing private sector investments to sustain momentum in capital formation.

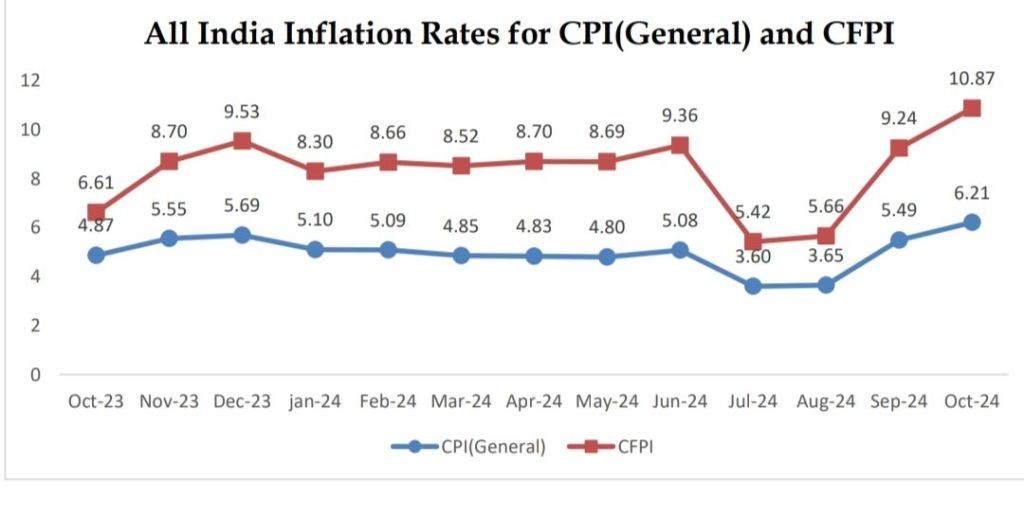

Inflation Dynamics

Inflation poses significant challenges, particularly for food prices.

- CPI Trends: General inflation moderated to 6.21% in October 2024, up from 4.87% in October 2023, reflecting uncontrolled increase in broader price levels.

- Food Inflation (CFPI): Food inflation surged to 10.87%, highlighting supply-side disruptions in agriculture and logistics. More importantly the highest inflation is of vegetables, pulses, fruits and cereals most of which have been staple food of an average Indian household making the daily meal much costlier.

Prescription: Policymakers must strengthen agricultural supply chains, invest in cold storage infrastructure, and stabilize input costs for farmers to curb food price volatility. Monetary measures alone will not suffice without addressing structural supply issues.

A Holistic View of the Indian Economy

The Indian economy exhibits a mixed picture of resilience and emerging vulnerabilities. While GDP growth remains robust relative to global peers, the slowdown from 8.2% to 6.0% underscores the need for structural reforms. Key challenges include labor market mismatches, persistent inflation, and uneven sectoral growth.

To ensure inclusive and sustainable growth, policymakers must:

- Address Employment Challenges: Foster labor-intensive manufacturing and expand rural employment opportunities beyond agriculture.

- Stabilize Inflation: Strengthen agricultural productivity and supply chains to reduce food price volatility.

- Boost Consumption and Investment: Balance fiscal consolidation with targeted public spending and incentivize private sector investments.

- Enhance Services Growth: Focus on urban job creation in high-value services and formalize informal employment sectors.

By addressing these interconnected challenges, India can sustain its growth trajectory, enhance living standards, and create a more equitable economy.