Recently, there has been a lot of conversation and debate around honorable FM Nirmala Sitharaman’s comment on millennial generation preference for car rentals playing a role in slowdown of passenger car (PC) sales in India. Let us examine the facts around this debate.

Firstly, it is not just the PC segment which is witnessing a slow down. Even the sales in commercial vehicles (CV) is witnessing a similar trend. Ashok Leyland, India’s second biggest CV manufacturer saw a 70% drop in Aug’19 sales vis-a-vis same period last year; Tata Motors – the segment leader, suffered a 58% drop. Secondly, Uber and Ola are also facing a slow down in growth in the last two years. The cab aggregators entered the Indian market around 2010 and added new markets rapidly – which peaked in 2014 when they entered 8 new markets. However, since then expansion in terms of geography has come down.

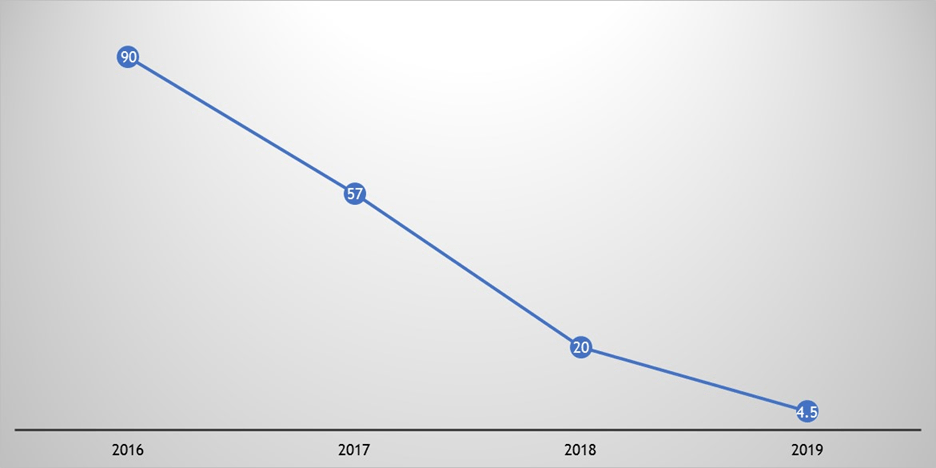

As a matter of fact, Uber and Ola are also facing a steep slowdown in growth in the last few years as can be observed from the below graph. From 2015->2016, Uber and Ola saw a 90% increase in no. of rides but this went down steadily in the succeeding years – from 2018 to 2019 (YTD), this growth has dropped to a mere 4.5%.

In fact, growth in registration of taxi segment has also gone down from 6%+ in 2012 to around 2% by 2016. Therefore, what appears is that weakening demand from taxi/rental segment has also played it’s part in the current distress in the PC category.

Also, share of taxi/rental in overall car sales by OEMs has not changed significantly in last 1 year. At Maruti, India’s largest passenger car OEM, share of taxi segment in car sales remains at around 6% at present – similar to last year. Thus if anything, taxi segment sales have also fallen at the same rate as overall PC sales have dipped. PC sales in the USA have been robust in the last few years – this despite Uber being a big player in the US commuting market. Thus, it is difficult to attribute direct linkage of car rental/aggregator growth with diminishing car sales.

Yet attributing slowdown of car sales to growth of Ola/Uber has been observed before as well. In 2015, Anand Mahindra, chairman of the Mahindra Group had stated that app cabs form the biggest threat to auto sales. Very recently, Uday Kotak, CMD of Kotak Mahindra Bank, had also expressed a similar sentiment. Ola and Uber’s initial surge in popularity was driven to a considerable extent by lessening aspiration values associated with car ownership as well as infrastructural challenges like lack of parking space, poor road surface condition, traffic congestion which made personal driving less appealing. Yet looking at current facts, it is difficult to attribute the present gloom in the passenger car segment to change in outlook and behavior of a demographic cross section only.

Nice

LikeLike